2023

2023

Annual and Sustainability Report

Gränges AB (publ)

2023 in brief

2023 in brief

Net sales

Net sales decreased to SEK 22,518 million (24,492).Adjusted operating profit

Adjusted operating profit increased to SEK 1,536 million (1,150).Return on capital employed

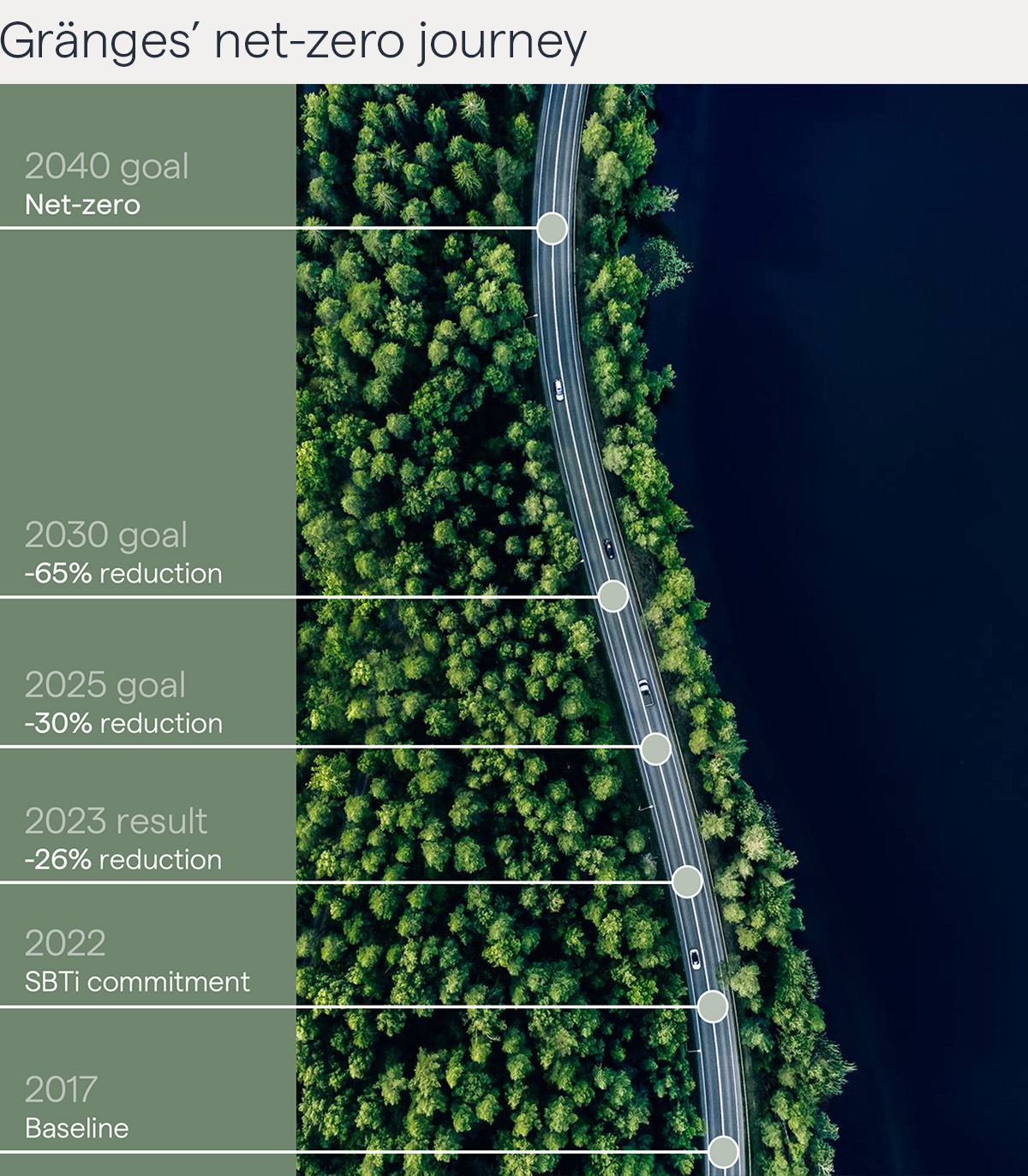

Return on capital employed increased by 2.8 percentage points to 12.2 percent.Carbon emissions intensity

Total carbon emissions intensity (scope 1+2+3) has been reduced by 26 percent versus baseline 2017.Sourced recycled aluminium

The share of sourced recycled aluminium increased above target level, to 41.6 percent (32.7).Responsible sourcing and production

All of Gränges’ 6 aluminium rolling and recycling sites have achieved certifications in accordance with the Aluminium Stewardships Initiative (ASI) Performance Standard and Chain of Custody Standard, thereby achieving the 2025 goal.CEO statement

CEO statement

2023 was a record year in many ways, thanks to excellent execution by the entire Gränges team. It was also a year characterized by general economic slowdown and uncertainty in the world around us. Despite a slightly lower sales volume, adjusted operating profit reached an all-time-high of SEK 1.5 billion, an impressive increase of 34 percent percent over 2022, which was also a record year. Our systematic work on productivity and price in all regions was the main contributor. We also achieved our lowest carbon emission intensity and highest recycling levels ever.

Targets

Financial targets

Profit Growth

Average yearly operating profit growth above 10 percent. Operating profit increased by 34 percent compared to last year, corresponding to 14 percent average 3y CAGR during the last three years. The increase was primarily driven by higher prices towards customers and improved productivity.Profitability

Return on capital employed above 15 percent. Return on capital employed increased by 2.8 percentage points to 12.2 percent. The increase in return on capital employed was primarily driven by increased adjusted operating profit and reduced working capital levels due to improved inventory management and reduced metal prices.Capital structure

Financial net debt normally between 1–2 times adjusted EBITDA. Financial net debt decreased by SEK 1,141 million to SEK 2,741 million, corresponding to 1.1 times adjusted EBITDA. Increased EBITDA and inventory management contributed to the decrease in financial net debt.Dividend

Dividend between 30–50 percent of profit for the year. The Board of Directors proposes a dividend of SEK 3.00 (2.50) per share for the 2023 fiscal year, corresponding to 32 (38) percent of the profit for the year.Sustainability goals

Net-zero

2025

Minimum reduction in carbon emissions intensity versus baseline 2017.2030

Minimum reduction in carbon emissions intensity versus baseline 2017.2040

Emissions across the value chain.2023 performance

Scope 1+2 intensity decreased by 20 percent to 0.66 tonnes CO2e/tonne (0.82) and Scope 3 intensity decreased by 4 percent to 7.8 (8.1). Total carbon emissions intensity (scope 1+2+3) has now been reduced by 26 percent versus baseline 2017.

Circular

2025

Minimum share of sourced recycled aluminium.2030

Volume of sourced recycled aluminium.2023 performance

The share of sourced recycled aluminium increased by 8.9 percentage points to 41.6 percent (32.7). The volume of sourced recycled aluminium increased by 24 percent to 210 ktonnes (169), which corresponds to 4.5x the volume in 2017.

Responsible

2025

Certified against the Aluminium Stewardship Initiative’s (ASI) sustainability standards.2030

Sustainable suppliers.2023 performance

In 2023, Gränges’ site in Konin achieved dual certifications against ASI’s Performance Standard and Chain of Custody Standard. This implies that all of Gränges’ aluminium rolling and recycling sites have now been ASI certified, thereby achieving the 2025 goal.

Strategy

Strategy

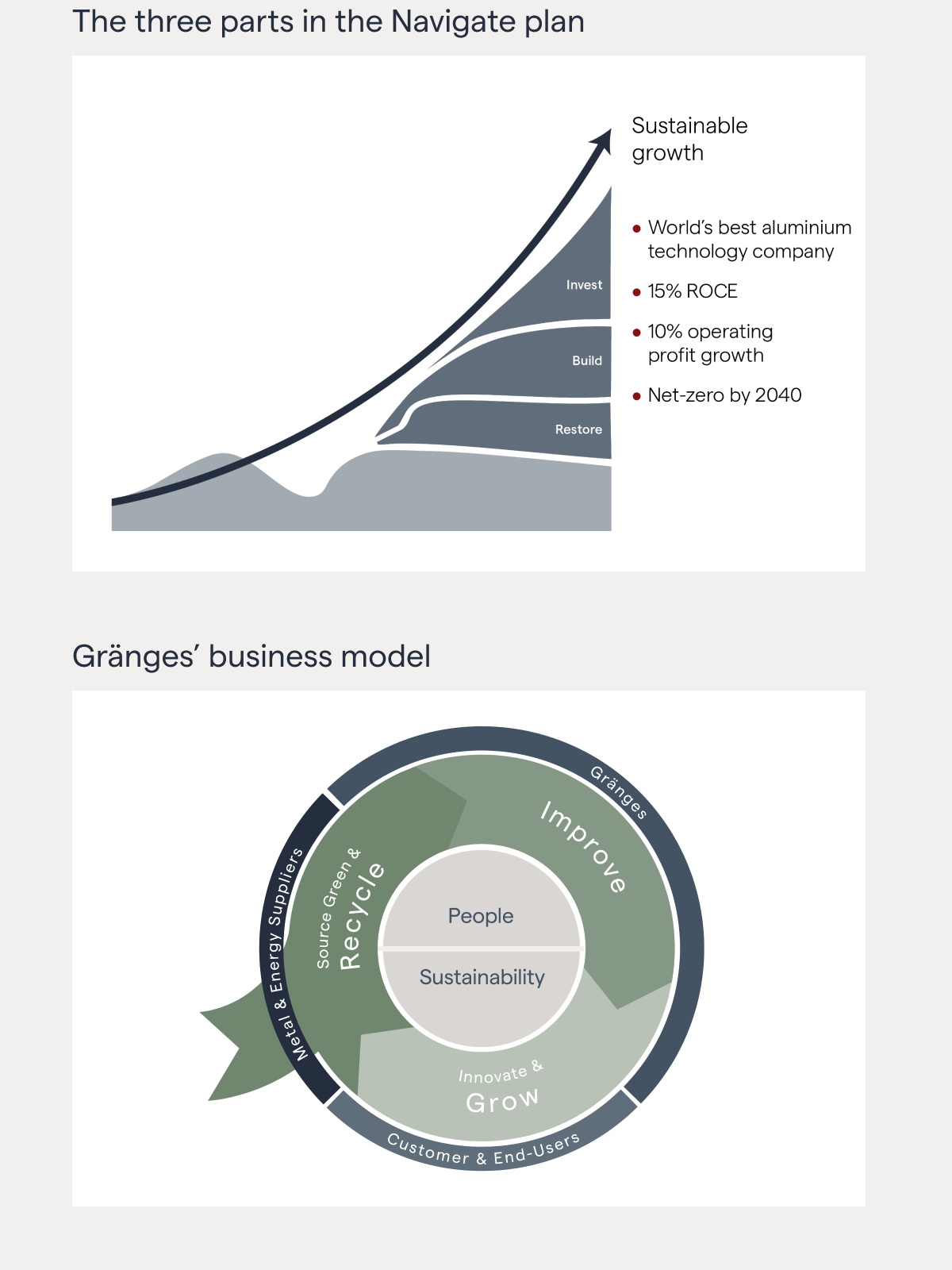

Navigate – Gränges’ strategy for long-term sustainable growth

Gränges has had many years of strong value creation. The positive trend was broken in 2019, following a period of large investments and further boosted by the effects from the COVID-19 pandemic. This called for action. Since 2022, the Navigate plan guides Gränges' efforts to restore solid performance, build a stronger company, and invest in sustainable growth.

Build – based on Gränges’ business model

The strategy part Build is based on Gränges’ business model covers the five areas; Improve, Innovate and grow, Source green and recycle, People and Sustainability. In the plan, global and regional perspectives are combined. This way of working enables focus, entrepreneurship and responsibility in each region. At the same time, it drives the Group's performance and strategy globally.

Restore leading value creation

The finalization of investment programs into Gränges' current production platform, as well as actions to utilize and optimize the platform, aim to restore the Group’s high value creation performance.

Invest in sustainable growth

Although Gränges works on restoring solid growth and returns, the company will continue to evaluate opportunities to create value through further investments in four areas: Recycling, Optimization, New markets and M&A and partnerships. These investments should focus on areas that, in combination with the company’s existing business, are likely to generate growth as well as stable returns in line with or above Gränges' financial targets, and to contribute positively to sustainability.

The Business

The business

Markets

The market for rolled aluminium materials, in which Gränges operates, is in general characterized by advanced technology, complex production processes, and customer-driven development with long-term relationships. Gränges’ solutions are used for efficient climate control in transportation and buildings, electrification and battery components,recyclable packaging, and more.Gränges Eurasia

Gränges Eurasia managed to increase both sales volume and operating profit through commercial flexibility, price management and productivity improvements despite challenging market conditions. The general economic slowdown put pressure on demand in most customer groups and the high-inflationary environment from the year before continued into 2023.Gränges Americas

Gränges Americas delivered a record profit during 2023 supported by strong market positions. Despite weakened demand in several market segments, Gränges Americas managed to keep focus on long-term value creation with continued investments in sustainable facilities taking advantage of strong macro trends such as regionalized supply chains and sustainability.Sustainability

Sustainability leadership

Future proofing our business

Enabler of the green transition

Aluminium plays an important role in the transition towards a circular and sustainable economy. The metal is for example used to produce lightweight vehicles, energy-efficient buildings, and resource-efficient packaging. Through lighter products, energy and emission savings can be achieved both operationally and in product usage.

Strong commitment to sustainability

Sustainability and people are at the core of Gränges’ business and strategy. The company has a strong position in the value chain and works to make a difference through its commitment to sustainability. This is driven by ambitious plans for net-zero, circularity as well as responsible production and practices. Gränges is committed to climate neutrality by 2040 and received approval of its net-zero and near-term 2030 goals from SBTi at the end of 2023.

Sustainable supply and recycling

Gränges’ plan for sustainable supply and recycling is focused on recycling growth, green supply of metals and energy, and ensuring responsible sourcing practices. A strong focus is to invest in partnerships with customers and suppliers, in new technical solutions and remelting, as well as in increased sourcing of renewable electricity.Sustainable operations

Gränges’ plan for sustainable operations is focused on resource efficiency (energy,water, waste), workplace safety, sustainable workplace, and ethical business practices. A strong focus is to strengthen operational efficiency and enforce a safety-first culture.Sustainable customers and sectors

To ensure that Gränges is part of the transition to a sustainable economy, the company is targeting sustainable sectors such as the electrical vehicle market. Another key priority is to partner with customers both in terms of designing and developing sustainable and circular solutions but also in establishing closed-loop business models.Corporate Reports

Corporate Reports and Financial Statements

Chairman’s statement

A record year for Gränges

In 2023, the general business environment was gradually normalized after a number of years with exceptionally challenging circumstances: the pandemic, lockdowns, global component shortages and supply chain constraints. The serious geopolitical situation, and the general economic slowdown, however, continued to affect many people and businesses. Guided by its Navigate strategy, Gränges successfully managed short-term challenges. It’s pleasing to see that the new strategy and combined efforts yielded the best result so far for Gränges, both in terms of operating profit and sustainability performance.

Case

Case

New recycling and casting line in Gränges Americas delivers on the Navigate strategy

Gränges’ USD 33 million investment in the expansion of its aluminum recycling and casting capacity in Huntingdon, Tennessee, was completed in early 2023. Already during the first year in operation, it contributed significantly to increased recycling, lower cost, lower working capital, and an improved carbon footprint.

”This is a major investment which underscores our dedication to our customers and markets, fortifying our foundation for sustainable growth.”

– Patrick Lawlor, President of Gränges Americas

A partnership for low-carbon aluminium

In 2023, Gränges formed a joint venture with Shandong Innovation Group (SIG), for a new recycling and casting operation in Yunnan, China. When fully operational, the company is expected to have a significant positive on the Group's carbon footprint.

Gränges gets ready for the electrified future

To meet the strong demand from the growing battery industry, Gränges has invested in cathode foil production in all regions. In the Navigate plan, Gränges aims to invest in sustainable markets and customers and the battery market fits right into this strategy.

"We aim to take a leading position within battery components,

which also includes casing and thermal management components."

– William B. Shannon, SVP Gränges’ Global Battery Foil Program

Safety weeks a key tool in enhancing Gränges’ safety culture

Not only are the safety weeks full of useful activities, but they are also important driver of the safety culture. This year, the sites in Konin, Finspång and Shanghai, had dedicated weeks. However, since safety has high priority for Gränges, awareness is part of everyone’s responsibility, every day, in every shift.

Pushing boundaries in partnership with Polestar 0 project

Polestar 0 is a project with the ambition to create a truly climate-neutral car by 2030 through innovative collaborations. Gränges is committed to drive the development of circular and sustainable solutions towards net-zero. The partnership with Polestar 0 project, formed in 2023, is now in an intensive initial development phase with focus on battery components and the thermal management system.

Download

Annual and Sustainability Report 2023

Download the complete Annual and Sustainability Report for 2023.

Swedish

Swedish